Right to Speedy Trial is right of accused - Supreme Court

16 06 2015

Tuesday

IN a recent judgement, the Supreme Court gave certain guidelines on 'speedy trial'. The Supreme Court forewarned that these propositions are not exhaustive. It is difficult to foresee all situations. Nor is it possible to lay down any hard and fast rules.

(1) Fair, just and reasonable procedure implicit in Article 21 of the Constitution creates a right in the accused to be tried speedily. Right to speedy trial is the right of the accused. The fact that a speedy trial is also in public interest or that it serves the social interest also, does not make it any the less the right of the accused. It is in the interest of all concerned that the guilt or innocence of the accused is determined as quickly as possible.

(2) Right to speedy trial flowing from Article 21 encompasses all the stages, namely the stage of investigation, inquiry, trial, appeal, revision and re-trial.

(3) The concerns underlying the right to speedy trial from the point of view of the accused are:

(a) the period of remand and pre-conviction detention should be as short as possible.

(b) the worry, anxiety, expense and disturbance to his vocation and peace, resulting from an unduly prolonged investigation, inquiry or trial should be minimal; and

(c) undue delay may well result in impairment of the ability of the accused to defend himself, whether on account of death, disappearance or non-availability of witnesses or otherwise.

(4) At the same time, one cannot ignore the fact that it is usually the accused who is interested in delaying the proceedings. As is often pointed out, "delay is a known defence tactic". Since the burden of proving the guilt of the accused lies upon the prosecution, delay ordinarily prejudices the prosecution.

(5) While determining whether undue delay has occurred (resulting in violation of Right to Speedy Trial) one must have regard to all the attendant circumstances, including nature of offence, number of accused and witnesses, the workload of the court concerned, prevailing local conditions and so on - what is called, the systemic delays. It is true that it is the obligation of the State to ensure a speedy trial and State includes judiciary as well, but a realistic and practical approach should be adopted in such matters instead of a pedantic one.

(6) Each and every delay does not necessarily prejudice the accused. Some delays may indeed work to his advantage. "it cannot be said how long a delay is too long in a system where justice is supposed to be swift but deliberate".

(7) We cannot recognize or give effect to, what is called the 'demand' rule. An accused cannot try himself; he is tried by the court at the behest of the prosecution. Hence, an accused's plea of denial of speedy trial cannot be defeated by saying that the accused did at no time demand a speedy trial.

(8) Ultimately, the court has to balance and weigh the several relevant factors - 'balancing test' or 'balancing process' - and determine in each case whether the right to speedy trial has been denied in a given case.

(9) Ordinarily speaking, where the court comes to the conclusion that right to speedy trial of an accused has been infringed the charges or the conviction, as the case may be, shall be quashed.

(10) It is neither advisable nor practicable to fix any time limit for trial of offences. Any such rule is bound to be qualified one. Such rule cannot also be evolved merely to shift the burden of proving justification on to the shoulders of the prosecution.

(11) An objection based on denial of right to speedy trial and for relief on that account, should first be addressed to the High Court. Even if the High Court entertains such a plea, ordinarily it should not stay the proceedings, except in a case of grave and exceptional nature. Such proceedings in High Court must, however, be disposed of on a priority basis.

The Supreme Court was actually dealing with a case of continued suspension of a Central Government employee since September 2011. The Supreme Court observed,

Suspension, specially preceding the formulation of charges, is essentially transitory or temporary in nature, and must perforce be of short duration. If it is for an indeterminate period or if its renewal is not based on sound reasoning contemporaneously available on the record, this would render it punitive in nature. Departmental/disciplinary proceedings invariably commence with delay, are plagued with procrastination prior and post the drawing up of the Memorandum of Charges, and eventually culminate after even longer delay.

Protracted periods of suspension, repeated renewal thereof, have regrettably become the norm and not the exception that they ought to be. The suspended person suffering the ignominy of insinuations, the scorn of society and the derision of his Department, has to endure this excruciation even before he is formally charged with some misdemeanour, indiscretion or offence. His torment is his knowledge that if and when charged, it will inexorably take an inordinate time for the inquisition or inquiry to come to its culmination, that is to determine his innocence or iniquity. Much too often this has now become an accompaniment to retirement.

If Parliament considered it necessary that a person be released from incarceration after the expiry of 90 days even though accused of commission of the most heinous crimes, a fortiori suspension should not be continued after the expiry of the similar period especially when a Memorandum of Charges/Chargesheet has not been served on the suspended person .

2015-TIOL-139-SC-SERVICE

CBDT issues instructions on Suspension

BASED on the above Supreme Court judgement, the CBDT has issued instructions to all the Principal Chief Commissioners of Income Tax to follow and direct their subordinates to follow the principles in the judgement.

CBDT refers to the following principles:

a) The direction of the Central Vigilance Commission that pending a criminal investigation, departmental proceedings are to be held in abeyance, is now superseded.

b) The currency of a Suspension Order should not extend beyond three months if within this period the Memorandum of Charges/Chargesheet is not served on the delinquent officer/employee.

c) If the Memorandum of Charges/Chargesheet is served, a reasoned order must be passed for the extension of the suspension.

d) The Government is free to transfer the concerned person to any Department in any of its offices within or outside the State so as to sever any local or personal contact that he may have and which he may misuse for obstructing the investigation against him.

e) The Government may also prohibit him from contacting any person, or handling records and documents till the stage, he is required to prepare his defence.

CBDT further directs that in all such cases where officers/officials are transferred to a different station after revocation of their suspension, the transfer order must specifically refer to the judgment in this case and mention about the liberty granted by the Hon'ble Supreme Court, so that the transfer cannot be challenged as being in violation of Transfer Policy. Further, in all such cases where the officers/ officials are retained at the same station after revocation of their suspension, orders may be issued prohibiting such officers/officials from contacting any person, or handling records and documents till the stage of their having to prepare their defence.

Will CBEC also issue such instructions?

DGIT(Vigilance) letter in F.HQ/Misc./2015-16/1285, Dated: June 05, 2015

Special Notified Zone - DGFT Notifies

GOVERNMENT has amended the Foreign Trade Policy, 2015-2020, by inserting a new paragraph 4.49A:

4.49A Special Notified Zone: Import, auction/sale and re-export of rough diamonds by entities, as notified vide RBI Notification 116 of 1st April, 2014, as amended from time to time, on consignment or outright basis, will be permitted in Special Notified Zone (SNZ) administered by the operator of SNZ, under supervision of Customs.

The procedure of import, auction/ sale and re-export of rough diamonds (unsold) would be as specified by CBEC.

The CBEC has already issued Circular No.17/2015-Cus ., Dated May 26 2015 in this regard.

DGFT Notification No.11/2015-2020., Dated: June 15, 2015

Deputy Commissioner Stayed Order of Commissioner

THIS may look strange in a hierarchy conscious department, but it really happened some thirty years ago. A veteran consultant who has decades of association with the Department told me this incident:

The Collector (as the Commissioner was then called) of Central Excise had undertaken a factory visit (something that used to be a tradition in those days). While on his rounds he found that the assessee was making a consolidated entry in the EB 4 Account (Stock Account) at the end of the factory day (6 AM to 6 AM) pursuant to a concession. This had been granted earlier based on the fact that there were adequate supplementary records (bin cards etc) to trace any package deposited in the storeroom to its source and the RG I.

Since this concession was ordered to be withdrawn immediately there was complete chaos in the bonded storeroom accounting process. It was impractical for the reason that stocks were deposited in several store rooms within the factory at the same time and used to be internally transported from the packing area through multiple means by conveyors, fork lift trucks, covered trolleys etc.

With the withdrawal of the concession and given the volume of stocks to be handled on any factory-day the speed of deposit of stocks in the bonded store rooms and their despatch from the factory was reduced considerably affecting duty payments as well. This was an unsustainable situation from the market perspective.

The Collector was on leave and I met the Deputy Collector with all the facts and a written representation. He quickly reviewed my representation and understood the core issue. Having satisfied himself that there were sufficient safeguards, he issued instructions across the table to hold the order of the Collector in abeyance till such time as the matter is examined in depth once again and allowed the erstwhile practice to continue.

What happened after the Collector came back? Did the Deputy Collector lose his job?

This is what happened:

The matter was entrusted to an erudite Assistant Collector (who had authored books) and after a detailed study he produced a report that was a treatise by itself! From an implementation perspective this was away from the ground level issues that are faced day to day in a factory. Bonds and Bank Guarantees to be put in place with periodic scrutiny and a host of supplementary records besides those that were already in place. The remedy was more tortuous than the concession.

But time is a great healer. The report took about six months and by then the Collector had moved out and there was another dynamic "boss" who occupied the chair. When the report was put to him he did not hesitate a bit to restore the earlier practice of a consolidated entry in a combined EB 4 and RGI with all the then prevailing safeguards.

A happy ending after a laborious process!

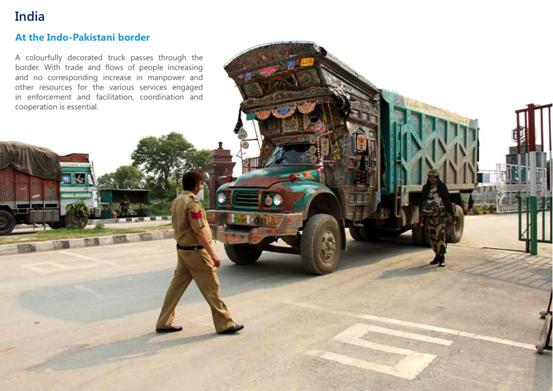

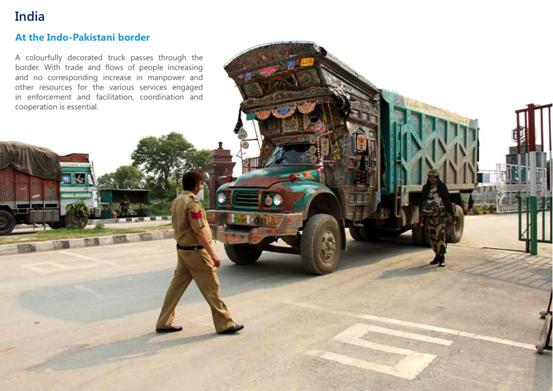

WCO Photo Competition 2015 - The Indian Entry

Tariff Value of Silver Decreased, oils Increased

THE Government has decreased the Tariff value of Silver from 544 USD to 519 USD per kilogram.

Tariff values of Poppy Seeds and Gold remain unchanged. Tariff Values of oils and areca nuts are increased. Brass scrap sees a downward trend.

The Tariff values as on 29.05.2015 and with effect from 15.06.2015 are as under:

|

Table 1

|

|

S. No.

|

Chapter/ heading/ sub-heading/tariff item

|

Description of goods

|

Tariff value USD (Per Metric Tonne) from 29.05.2015

|

Tariff value USD (Per Metric Tonne) from 15.06.2015

|

|

(1)

|

(2)

|

(3)

|

(5)

|

(6)

|

| 1 |

1511 10 00 |

Crude Palm Oil |

657 |

680 |

| 2 |

1511 90 10 |

RBD Palm Oil |

676 |

690 |

| 3 |

1511 90 90 |

Others - Palm Oil |

667 |

685 |

| 4 |

1511 10 00 |

Crude Palmolein |

682 |

701 |

| 5 |

1511 90 20 |

RBDPalmolein |

685 |

704 |

| 6 |

1511 90 90 |

Others -Palmolein |

684 |

703 |

| 7 |

1507 10 00 |

Crude Soyabean Oil |

789 |

800 |

| 8 |

7404 00 22 |

Brass Scrap (all grades) |

3657 |

3592 |

| 9 |

1207 91 00 |

Poppy seeds |

2602 |

2602 |

|

Table 2

|

|

S. No.

|

Chapter/ heading/ sub-heading/tariff item

|

Description of goods

|

Tariff value USD from 29.05.2015

|

Tariff value USD from 15.06.2015

|

| 1 |

71 or 98 |

Gold, in any form in respect of which the benefit of entries at serial number 321 and 323 of the Notification No. 12/2012-Customs dated 17.03.2012 is availed. |

385 per 10 grams |

385 per 10 grams |

| 2 |

71 or 98 |

Silver, in any form in respect of which the benefit of entries at serial number 322 and 324 of the Notification No. 12/2012-Customs dated 17.03.2012 is availed. |

544 per kilogram |

519 per kilogram |

|

Table 3

|

|

S. No.

|

Chapter/ heading/ sub-heading/tariff item

|

Description of goods

|

Tariff value USD (Per Metric Tons) from 29.05.2015

|

Tariff value USD (Per Metric Tons) from 15.06.2015

|

| 1 |

080280 |

Areca nuts |

2264 |

2268

|

Notification No. 61/2015-Cus.(N.T.), Dated: June 15, 2015

Until Tomorrow with more DDT

Have a nice day.

Mail your comments to vijaywrite@tiol.in