'Bill to - Ship to' Model under the draft India GST law

SEPTEMBER 15, 2016

By Ramnarayan Balakrishnan

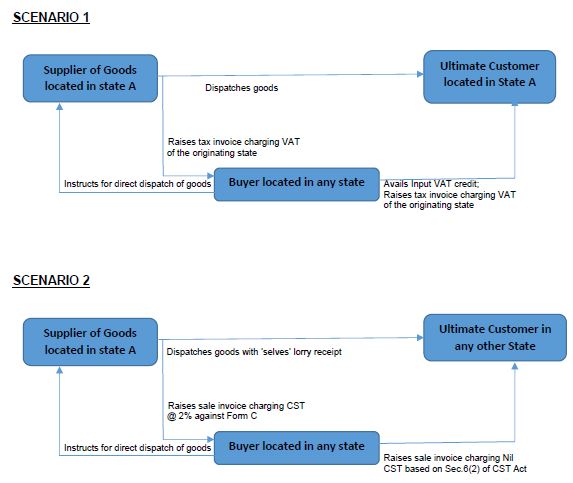

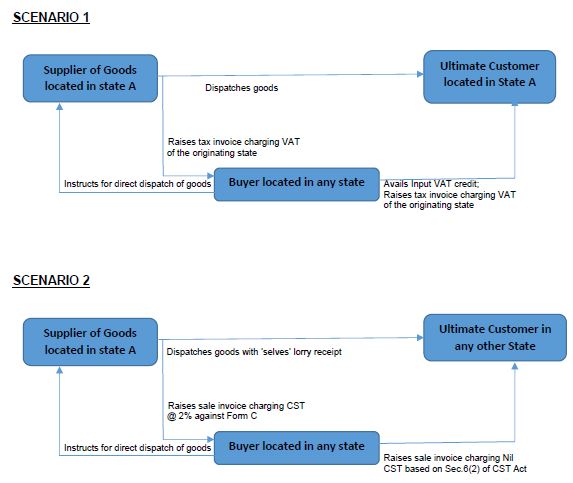

UNDER the current VAT/ CST regime, the "Bill to - Ship to" model can be classified under two scenarios, as explained below:

UNDER the current VAT/ CST regime, the "Bill to - Ship to" model can be classified under two scenarios, as explained below:

A. The Current VAT/ CST regime

Those in the field of Indirect taxation would be familiar with both the above scenarios and the related documentation/ declaration form particulars.

B. The proposed GST regime

Chapter V, Section 5(2A) of the draft IGST Act reads as below (verbatim):

"Where the goods are delivered by the supplier to a recipient or any other person, on the direction of a third person, whether acting as an agent or otherwise, before or during movement of goods , either by way of transfer of documents of title to the goods or otherwise, it shall be deemed that the said third person has received the goods and the place of supply of such goods shall be the principal place of business of such person. "

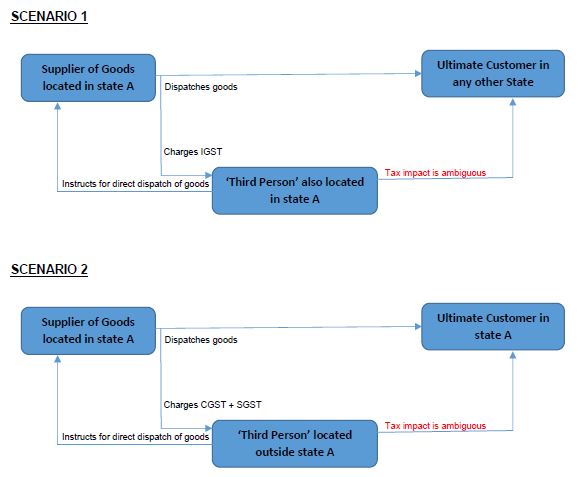

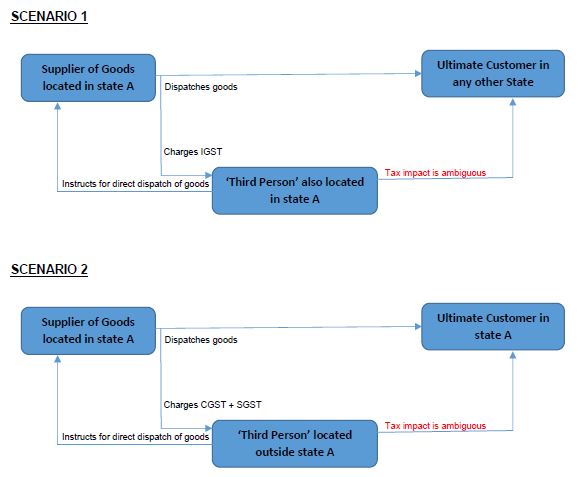

It could be inferred from the above section that, the supply can be intra-state, but the tax trigger/ place of supply would be the location of the third person who gives instructions for delivery of the goods.

In other words, a person could supply goods intra-state (which ideally should trigger CGST + SGST), but, if the "third person" who gives instructions for such supply is located outside the particular state, then, regardless of the actual movement of goods, the location of such person would be deemed to be the place of supply and result in triggering of IGST.

As a corollary, if the 'third person' discussed under Section 5(2A) of the IGST Act, is located in the same state as the supplier but issues instructions for delivery of the goods on inter-state basis (which ideally should trigger IGST), then, regardless of the actual movement of goods, his location would be deemed to be the place of supply and result in triggering of CGST + SGST.

The aspects discussed above are only in relation to the first leg of the transaction, i.e. between the Supplier of goods and the 'third person', whether located within or outside the state.

The next point to reckon with would be the nature of the second leg of the transaction, i.e. between the 'third person' and the ultimate customer who receives the goods.

Whether a transaction triggers IGST or CGST+SGST is based on whether the supply is interstate or intra-state. Insofar as the 'bill to - ship to' model is concerned, there is just one transaction of movement of goods from the Supplier to the Ultimate Customer. The transactions between the 'third person' and the Ultimate Customer are just paper transactions. This being the case, it is not clear as to how the second leg of the transaction would be treated.

Consequently, the eligibility of input credit corresponding to the above transaction is also ambiguous.

The VAT/ CST scenarios we adopted earlier would be as given below under the GST 'Bill to - Ship to' model:

Hopefully, before the country embarks on its GST voyage, it would be in the fitness of things that the essentials are made crystal clear by the authorities concerned. Else, with the 'skimpy' threshold limits that is proposed to be adopted, we may end up with a GST nightmare!

(The author is Senior Analyst - Tax Research, Vertex Tax Solutions India Private Limited and the views expressed are strictly personal.)

|

(DISCLAIMER : The views expressed are strictly of the author and Taxindiaonline.com doesn't necessarily subscribe to the same. Taxindiaonline.com Pvt. Ltd. is not responsible or liable for any loss or damage caused to anyone due to any interpretation, error, omission in the articles being hosted on the site)

|

UNDER the current VAT/ CST regime, the "Bill to - Ship to" model can be classified under two scenarios, as explained below:

UNDER the current VAT/ CST regime, the "Bill to - Ship to" model can be classified under two scenarios, as explained below: