Scary Summons - judicial proceedings

JANUARY 13, 2021

By Vijay Kumar

THE specially selected taxpayers, who are bestowed with the honour of being summoned by the GST department, usually don't jump up in pleasure at the unique privilege, but actually shiver in unbounded fear. Many believe that being summoned is the first step to the distinction of being a state guest (aka arrested), with no immediate bail and so one has to rush to the nearest court through the nearest and not necessarily the best (difficult to find) lawyer.

Section 70 of the CGST Act, 2017 reads as:

70. (1) The proper officer under this Act shall have power to summon any person whose attendance he considers necessary either to give evidence or to produce a document or any other thing in any inquiry in the same manner, as provided in the case of a civil court under the provisions of the Code of Civil Procedure, 1908.

(2) Every such inquiry referred to in sub-section (1) shall be deemed to be a "judicial proceeding" within the meaning of section 193 and section 228 of the Indian Penal Code.

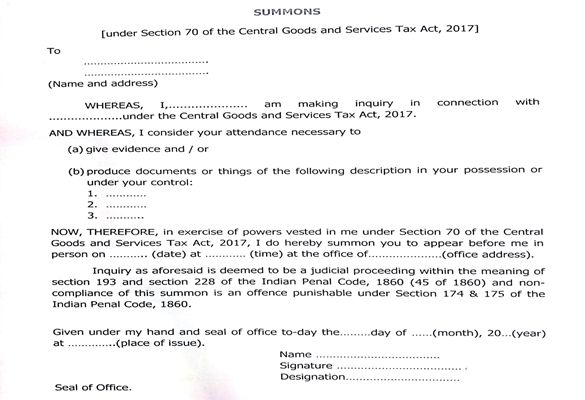

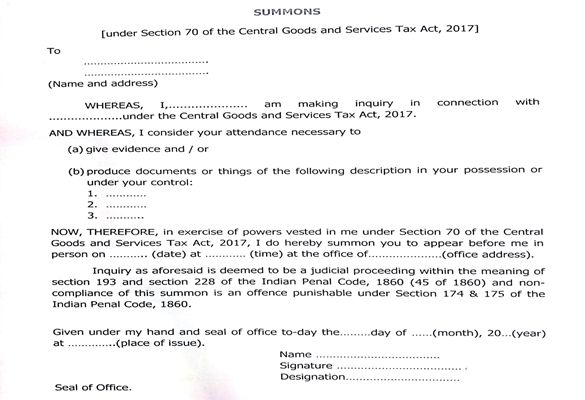

The CBIC by Circular No. 128/47/2019 - GST dated, December 23, 2019, issued a standardised form for summons, which is as under.

So, the proper officer can summon any person and the summons form informs that the Inquiry is deemed to be a judicial proceeding within the meaning of section 193 and section 228 of the Indian Penal Code, 1860 and non-compliance of the summon is an offence punishable under Section 174 & 175 of the Indian Penal Code, 1860.

[Actually, summon is a verb; the noun is summons and the plural of this singular noun is summonses. They don't employ English teachers in the law making bodies of the Government of India.]

These are judicial proceedings only within the meaning of section 193 and section 228 of the Indian Penal Code. What are they?

Section 193: PUNISHMENT FOR FALSE EVIDENCE.

Whoever intentionally gives false evidence in any stage of a judicial proceeding, or fabricates false evidence for the purpose of being used in any stage of a judicial proceeding, shall be punished with imprisonment of either description for a term which may extend to seven years, and shall also be liable to fine; and whoever intentionally gives or fabricates false evidence in any other case, shall be punished with imprisonment of either description for a term which may extend to three years, and shall also be liable to fine.

Section 228 Intentional Insult or Interruption to Public Servant Sitting in Judicial Proceeding.

Whoever intentionally offers any insult, or causes any interruption to any public servant, while such public servant is sitting in any stage of a judicial proceeding, shall be punished with simple imprisonment for a term which may extend to six months, or with fine which may extend to one thousand rupees, or with both.

So, the proceedings are judicial only to the extent as seen above. The Telangana High Court in PV Ramana Reddy vs Union of India - 2019-TIOL-873-HC-TELANGANA-GST, observed,

19. The interesting part of Section 70 is sub-Section (2) of Section 70. This sub-Section declares every enquiry to which Section 70(1) relates, to be deemed to be a judicial proceeding within the meaning of Sections 193 and 228 of the Indian Penal Code. As a consequence, a person who is summoned under Section 70(1) of the CGST Act, 2017, to give evidence or to produce document becomes liable for punishment, if he intentionally gives false evidence or fabricates false evidence or intentionally offers any insult or causes any interruption to any public servant.

20. Therefore, even if the enquiry before the Proper Officer under CGST Act, 2017 is not by its nature, a criminal proceeding, it is nevertheless a judicial proceeding and hence, the person summoned is obliged not to give false evidence nor to fabricate evidence. He is also obliged not to insult and not to cause any interruption to the Proper Officer in the course of such proceedings.

Okay, if you obey the summons and go to the officer, you are liable to be punished if you give false evidence or insult the proper officer.

But what is the punishment, if any, for disobeying summons?

The CBIC Summons form answers that also - non-compliance of this summon is an offence punishable under Section 174 & 175 of the Indian Penal Code, 1860. Let us see what these sections are:

174 NON-ATTENDANCE IN OBEDIENCE TO AN ORDER FROM PUBLIC SERVANT.

Whoever, being legally bound to attend in person or by an agent at a certain place and time in obedience to a summons, notice, order or proclamation proceeding from any public servant legally competent, as such public servant, to issue the same, intentionally omits to attend at that place or time, or departs from the place where he is bound to attend before the time at which it is lawful for him to depart, shall be punished with simple imprisonment for a term which may extend to one month, or with fine which may extend to five hundred rupees, or with both;

175. Omission to produce document or electronic record to public servant by person legally bound to produce it.-

Whoever, being legally bound to produce or deliver up any document or electronic record of any public servant, as such, intentionally omits so to produce or deliver up the same, shall be punished with simple imprisonment for a term which may extend to one month, or with fine which may extend to five hundred rupees, or with both.

Thus, any person who is summoned by the GST Officer

1. Should attend (in person) at the time and place as per the convenience of the officer. The benign officer may grant adjournments, if properly explained/requested.

2. Should produce the documents asked for.

3. Should not give false evidence.

4. Should not fabricate evidence.

5. Should not insult the Proper Officer

6. Should not cause any interruption to the Proper Officer in the course of such proceedings.

Can he remain silent? An accused summoned by a police officer in criminal proceedings has the right to silence, but any person summoned by a GST Officer is not an accused (yet) and the GST officer is not a police officer. So, it is doubtful if this any person has the right to silence. In any case, they are not calling you to hear your silence, they know how to make you sing.

Power to arrest: The respected newspaper, 'The Hindu' reported on 11th January 2021 – "HC upholds arrest provision in CGST Act for tax evasion". The paper said, The Delhi High Court has upheld the controversial provisions in the Central Goods and Service Tax (CGST) Act that gives power to authorities to arrest any person if there is "reason to believe" that he has committed tax evasion.

What the High Court said was - 2021-TIOL-89-HC-DEL-GST this Court is of the prima facie opinion that the pith and substance of the CGST Act is on a topic, upon which the Parliament has power to legislate as the power to arrest and prosecute are ancillary and/or incidental to the power to levy and collect Goods and Services Tax.

In fact, the High Court clarified that the observations made herein are prima facie and shall not prejudice either of the parties at the stage of final arguments of the present writ petitions or in the proceedings for interim protection.

The newspaper report is being widely circulated even among lawyers.

Actually, the same issue is before the Punjab & Haryana High Court (and maybe several other high courts) in the case reported by us as - 2020-TIOL-1028-HC-P&H-GST. The next date of hearing is 19.01.2021. Anyway, the eventual destination is the Supreme Court.

Sankranti Greetings

Let the celestial event happening this coming week of the Sun's transit into Makara rashi (Capricorn), marking the end of the winter solstice and the start of longer and brighter days, bring to you and your family the positive glow of joy and good health.

Disclaimer: This is not my own; this is from the CBIC Chairman Mr. Ajit Kumar's weekly letter (11th January 2021) to his staff. I hope the positive glow of joy applies mutatis mutandis to all the beloved taxpayers. Incidentally mutatis mutandis does not mean identical application, it means with necessary changes. Black's Law Dictionary defines it as - With the necessary changes in points of detail, meaning that matters or things are generally the same, but to be altered when necessary, as to names, offices, and the like.

Until next week