Unchartered Audit?

MARCH 24, 2021

By Vijay Kumar

SUB-SECTION (5) of section 35 of the CGST Act reads as:-

(5) Every registered person whose turnover during a financial year exceeds the prescribed limit shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed.

The Finance Bill 2021 presented to Parliament on 1st February 2021, by clause 101, proposed to omit this sub-section.

101. In section 35 of the Central Goods and Services Tax Act, sub-section (5) shall be omitted.

Naturally, the Chartered Accountants and Cost Accountants were appalled, anguished and agitated.

But why was this amendment brought in?. As the Finance Minister told the Lok Sabha even yesterday, "The GST related matters are not the matters of the Ministry of Finance, but they are the GST Council matters in which all States Finance Ministers are members." It is not like the Finance Minister sitting in North Block decides.."

So, it was the GST Council, which recommended this amendment. See what happened in the GST Council…

From the Minutes of the 39th GST Council Meeting held on 14th March, 2020

13.5 The major cost for the tax payers comes out of the fees paid to the auditing Chartered Accountant/Cost Accountant. He informed that in fact, based on an analysis done, below Rs 5 crore limit, the additional tax recovered from each tax payer was Rs 13,000 per tax payer whereas the compliance cost was appx. Rs 50,000.

13.8 the proposal is to remove the requirement of filing of reconciliation statement by Chartered Accountant or Cost Accountant. Further, the reconciliation statement would not be separately required and will be merged with the Annual return and the same may be mandated for a particular class of person only.

Accordingly, the Law Committee has recommended omission of sub-section (5) of section 35, and that is what has been done in Clause 101 of the Finance Bill 2021.

|

Agenda Item 5A(vi): Filing of GSTR-9 (Annual Return) and GSTR-9C (Reconciliation Statement)

- A lot of negative feedback was received regarding filing of annual return and reconciliation statement for FY 2017-18. Most of the feedback is on non- working of the IT portal

- Due date for filing Annual Return and Reconciliation statement for 2017-18 was extended 7 times

- It has also been reported that the cost of compliance for filing of Annual Return and Reconciliation has been high especially for smaller taxpayers since this process requires engagement of a tax professional (Chartered Accountant or Cost Accountant) who reportedly insist that they should be engaged for the entire compliance management process throughout the year thus pushing the cost of compliance

- It is seen that additional tax of about Rs. 3176 Crores (Rs. 2079 Cr. In cash) additional tax and Rs. 575.76 Cr. interest thereon got collected from Annual Return GSTR-9.

- Additional revenue from GSTR-9C based on the Auditor's recommendations has been relatively low at Rs. 392 Cr. (Rs. 261 Cr. in cash) and Rs. 81.16 as interest

|

The BusinessLine reported on 10th February 2021,

The CA Institute has knocked the doors (how could they?) of the Prime Minister's Office and the Finance Minister seeking a withdrawal of the Budget proposal to do away with mandatory annual audit and reconciliation statement certification by a chartered accountant in respect of Goods and Services Tax (GST).

This Budget proposal has left the chartered accountants fraternity in a state of shock, prompting the CA Institute to demand a rollback of the move.

Confirming that CA Institute has sought a rollback of this proposal, Atul Kumar Gupta, outgoing President of ICAI, told BusinessLine that formal representation was made to PMO and Finance Ministry about 4-5 days ago.

"Removal of GST audit should not be seen as one perspective of ease of doing business. Doing away with GST audit will be a retrograde step as it will create greater problems for society in days to come if there is no concept of maker checker," Gupta said.

He highlighted that the audit fraternity has through various audits been instrumental in arranging over Rs. 20,000 crore of additional taxes flow to the exchequer. "GST audit helps in prevention and early detection of disease. When we do reconciliation audit, we look at 20 different things from compliances point of view. That will not be done if Budget proposal goes through. Maker checker concept will not be there," he said.

Accounting Professionals hoped that the Finance Minister will roll back the proposed amendment. Nothing of the sort happened. The Finance Bill was passed by Lok Sabha yesterday, without the Finance Minister even making a nodding reference to the issue. Apparently, she couldn't. The decision was taken in March 2020, when the GST Council recommended the amendment and once the GST Council had taken a decision, there is hardly anything the Finance Minister could do. Maybe the auditors should have persuaded the GST Council to reverse its decision.

Anyway, it's over now - at least for now. The Bill will become Act very soon. And the government considers it a facilitation measure. It is not mandatory and if a taxpayer wants the services of a chartered accountant for his comfort of maker checker, he can always hire a chartered accountant and no law can prevent that.

So, will the taxpayers cheer or fear?

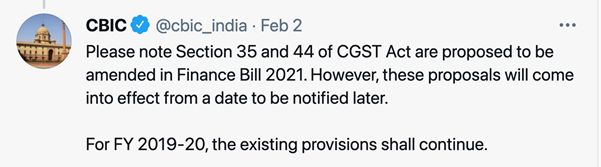

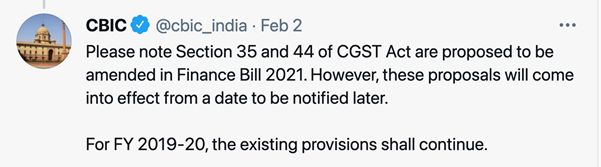

But there is some good news. This doing away with audit is not immediate. This provision has to be passed by all State legislatures and then an effective date will be notified. So, for the year 2019-20, audit is mandatory as the CBIC clarified in a tweet.

Merrily!

Uniformed GST

A Lok Sabha Member asked, "Will the Minister of FINANCE be pleased to state:

(a) the laws, rules and guidelines related to wearing of khaki uniform by the officers in Central Goods and Services Tax (CGST) department, guard of honour, control room duty, parade and escort in force at present;

(b) the utility/role of the said officers at present in terms of public service or public interest;

(c) the details of orders related to guard of honour and control room duty issued by the CGST department during the last three years;

(d) the rules/guidelines related to providing uniform allowance to the officers under the CGST department including the Grade-wise officers/employees along with their number who have been provided uniform allowance including the Year-wise total amount of uniform allowance provided during the last three years; and

(e) whether the Government has notified CGST department as uniformed service and its officers as Uniformed Officer and if so, the details thereof?

And the Finance Minister replied on 22 nd March 2021,

a) Khaki uniform has not been prescribed under any specific provision of CGST Act 2017. The Central Excise Act is still in force. As per the proviso to Section 3 of CGST Act 2017, the Central Excise officers are deemed to be officers under the CGST Act 2017. Khaki uniform has been prescribed under Chapter 7 of the Central Excise, Circle and Divisional Office Procedure manual, 1975.

b) The CGST officers deal with the tax evasion matters related to Central Excise, Customs and CGST which entails search of a premise/person, stopping a vehicle/vessel, arrest of an offender, border patrolling and guarding of premises. Uniform helps the trade identity of departmental officers and prevents impersonation. It also helps the departmental officers in discharging their official duties. Further, uniform was also prescribed to maintain and encourage a proper sense of discipline and to ensure proper turnout.

c) No order/instructions have been issued by the Department relating to guard of honour and control room duty in the last three years.

d) The Department of Expenditure OM dated 02.08.2017 has prescribed dress allowance to various forces including executive staff of Customs, Central Excise & Narcotics Department (both in summer and summer-cum-winter). The same has been circulated vide letter F.No. 26017/22/2008-Ad.IIA dated 04.10.2017. Grade-wise officers/employees along with their number who have been provided uniform allowance Year-wise during the last three years is given in Annexure-A.

e) No, sir. However, in terms of guidelines issued vide para 182 of Section 1 of Chapter 7 of the Central Excise Office Procedure Manual, 1975 officers in the rank of Assistant Commissioner and below are required to wear uniform while on duty.

The All India Central Excise Inspectors Assn had filed a writ in the Allahabad High Court pleading inter alia for 'issue of a writ, order or direction in the nature of Mandamus thereby directing the Union of India and Central Board of Indirect Taxes & Customs and GST Council to withdraw all the Memos, vigilance inquires or any other disciplinary actions against the executive staff in absence of any Rules and Guidelines regard wearing of Uniform'.

The High Court in an order dated 17.03.2021 - 2021-TIOL-681-HC-ALL-SERVICE, observed,

Learned counsel for petitioner has also not been able to indicate any prejudice which could be caused to the members of the associations in case they are required to wear uniform. The prayer made in the writ petition are completely vague in nature without indicating any specific order or memorandum that the petitioner is challenging.

Humour in uniform will continue. Please also see GST Jest in Uniform

Until next week