Covid cannot wither nor Customs stale its infinite variety

MAY 05, 2021

By Vijay Kumar

IF I have to state two things which are the most difficult to understand, I would say they are Covid and GST and as a person affected by both (as most of us are), I must say Covid is easier to deal with.

The Government has been kind enough to issue several covid related notifications in public interest, many of which you can easily understand with the help of some extraordinarily brilliant consultants. Even the CBIC has made a marvellous attempt to explain the welfare measures in a PIB Press Release dated 2nd May 2021, which states,

In view of the challenges faced by taxpayers in meeting the statutory and regulatory compliances under GST law due to the outbreak of the second wave of COVID-19, the Government has issued notifications, all dated 1st May, 2021, providing various relief measures for taxpayers. These measures are explained below:

Tax Rate of Oxygen Concentrator

As a sample, let us study the tax on Oxygen concentrator.

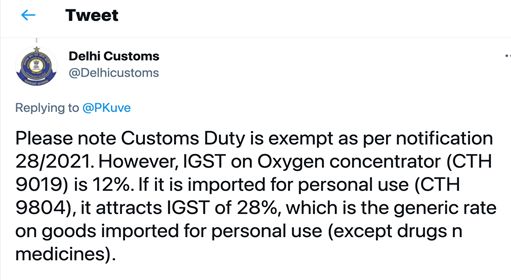

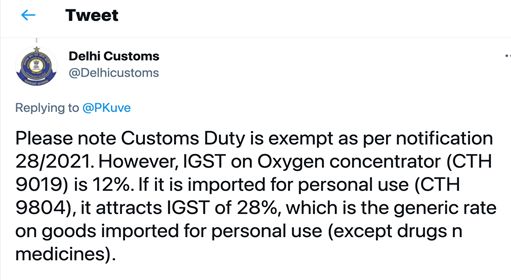

By Notification No. 28/2021-Customs, dated 24th April, 2021, the Government exempted Oxygen concentrator including flow meter, regulator, connectors and tubings falling under Chapter headings 9019 and 9804 when imported into India, from the whole of the duty of customs. People believed that there would be no duty/tax on import of Oxygen concentrator. The Delhi Customs on 30th April 2021 clarified in a tweet

Though Customs Duty was exempted, there was IGST of 12% for general imports and an IGST of 28% if imported for personal use. If you could manage to get a gift of an oxygen concentrator from a relative or friend abroad, you had to pay 28% IGST before you started breathing that gifted oxygen.

The Government realised this anomaly and on 1st May 2021 issued Notification No. 30/2021-Customs prescribing an effective rate of 12% for Oxygen concentrator, imported for personal use under chapter heading 9804.

By Ad hoc Exemption Order No. 4/2021-Customs, dated 3rd May, 2021, the Government exempted Covid related items when imported from the whole of the IGST subject to the following conditions:

1. The said goods are imported free of cost for the purpose of Covid relief by a State Government or, any entity, relief agency or statutory body, authorised in this regard by any State Government.

2. The said goods are received from abroad for free distribution in India for the purpose of Covid relief.

3. Before clearance of the goods, the importer produces to the Deputy or Assistant Commissioner of Customs, as the case may be, a certificate from a nodal authority, appointed by a State Government, that the imported goods are meant for free distribution for Covid relief, by the State Government, or the entity, relief agency or statutory body, as specified in such certificate.

4. The importer produces before the Deputy or Assistant Commissioner of Customs, as the case may be, at the port of import within a period of six months from the date of importation, or within such extended period not exceeding nine months from the said date as that Deputy or Assistant Commissioner of Customs may allow, a statement containing details of goods distributed free of cost duly certified by the said nodal authority of the State Government.

The Government by a PIB Press Release clarified that:

The Central Government had received a number of representations from charitable organizations, corporate entities, and other Associations/ entities outside India seeking exemption from IGST on the import of Covid-19 relief material (already exempted from customs duty), donated/received free of cost from outside India for free distribution. Accordingly, the Central Government has vide Ad hoc exemption Order number 4/2021 dated 3rd May, 2021 has granted exemption from IGST on import of such goods received free of cost for free distribution for covid relief.

This exemption, shall thus enable import of the covid relief supply imported free of cost for free distribution without payment of IGST (upto the 30th June, 2021).

As customs duty is already exempt, these imports will not attract any customs duty or IGST.

A philanthropic taxpayer asked me,

1. I want to import Oxygen Concentrator for my personal use;

2. I want to import Oxygen Concentrator for free distribution;

3. I don't have anybody abroad who would give me free Oxygen Concentrator;

4. What should I do?

When I tried to explain to him, he politely said, "thank you; I will try for some vaccine here." Obviously, I failed to make him understand these simple things - after all covid is very difficult to understand!

Record GST Collection

In all this confusion and calamity, the Government kitty was getting filled handsomely. A PIB Press Release stated,

The gross GST revenue collected in the month of April 2021 is at a record high of Rs. 1,41,384 crore of which CGST is Rs. 27,837 crore, SGST is Rs. 35,621, IGST is Rs 68,481 crore (including Rs. 29,599 crore collected on import of goods) and Cess is Rs. 9,445 crore (including Rs. 981 crore collected on import of goods). Despite the second wave of COVID-19 pandemic affecting several parts of the country, Indian businesses have once again shown remarkable resilience by not only complying with the return filing requirements but also paying their GST dues in a timely manner during the month.

The GST revenues during April 2021 are the highest since the introduction of GST even surpassing collections in the last month (March 2021).

Until next week